The Company’s Share Capital Stands At RM230.5 Million Comprising 830,433,122 Ordinary Shares And Total Assets At Group Level Standing At RM12.7 Billion As At 31 December 2021.

For over thirty years, our company has been one of the leading Takaful operators in Malaysia and has provided the financial strength and risk management expertise that fulfils our customers’ needs across our 24 service centres. The organization has evolved to meet clients’ needs by working closely with them and our consistent profitable growth over the years has enabled our company to provide high returns to our valued shareholders. With our portfolio of Family and General Takaful businesses, our multi-channel distribution capability, strong strategic partnerships, customer-centric products and services, and considerable brand equity, Takaful Malaysia is committed to helping people achieve their ambitions of a brighter and financially more secure future.

We have successfully set the benchmark in the Takaful industry for our peers and competitors. Our awards and achievements are an acknowledgement from the market and we are proud of the teams that work so hard to make these awards possible. Continuing as a pioneer in our industry, we are the first and only Takaful operator that has been consistently rewarding Cash Back to our General Takaful customers for making no claims during the coverage period.

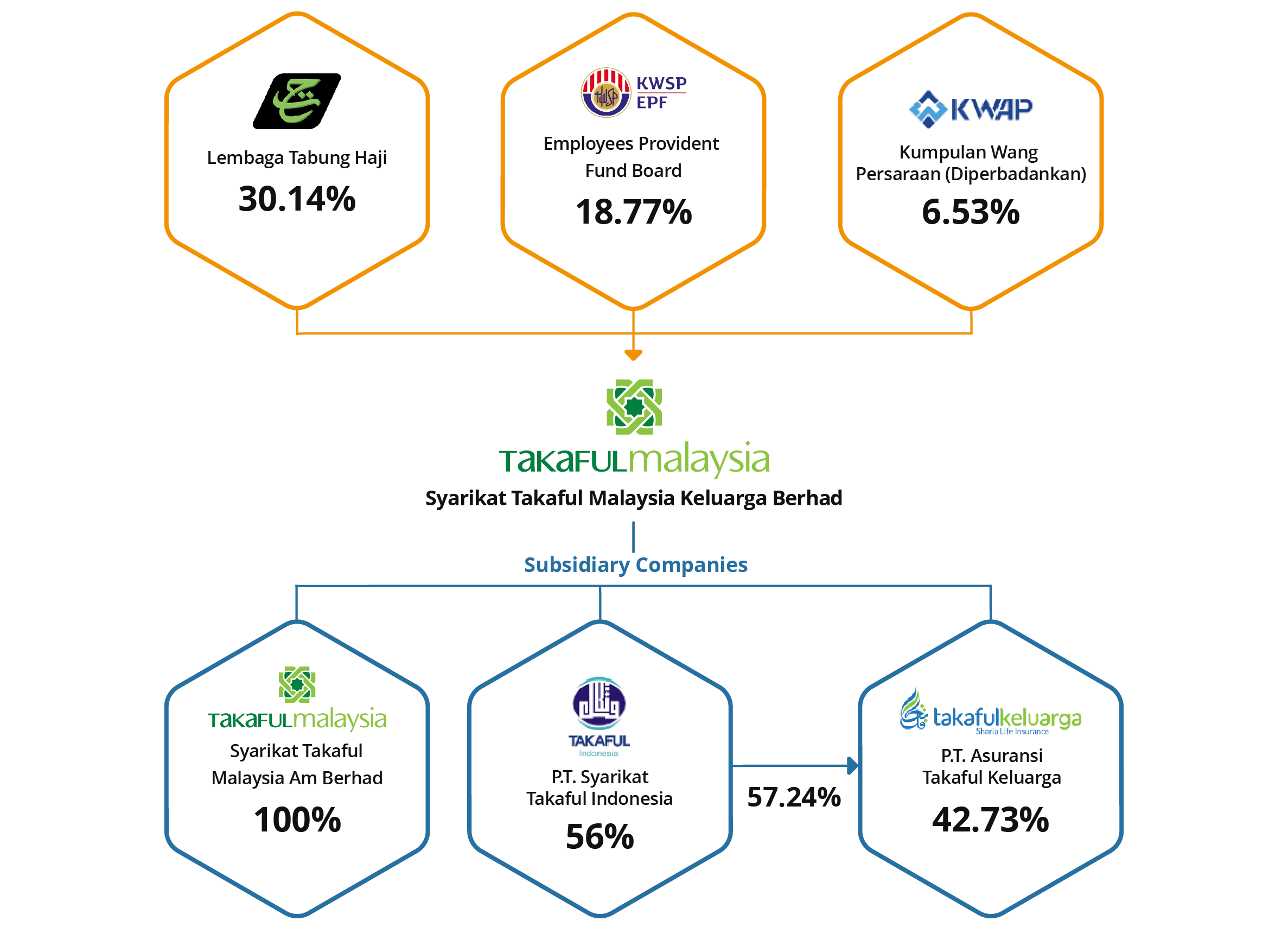

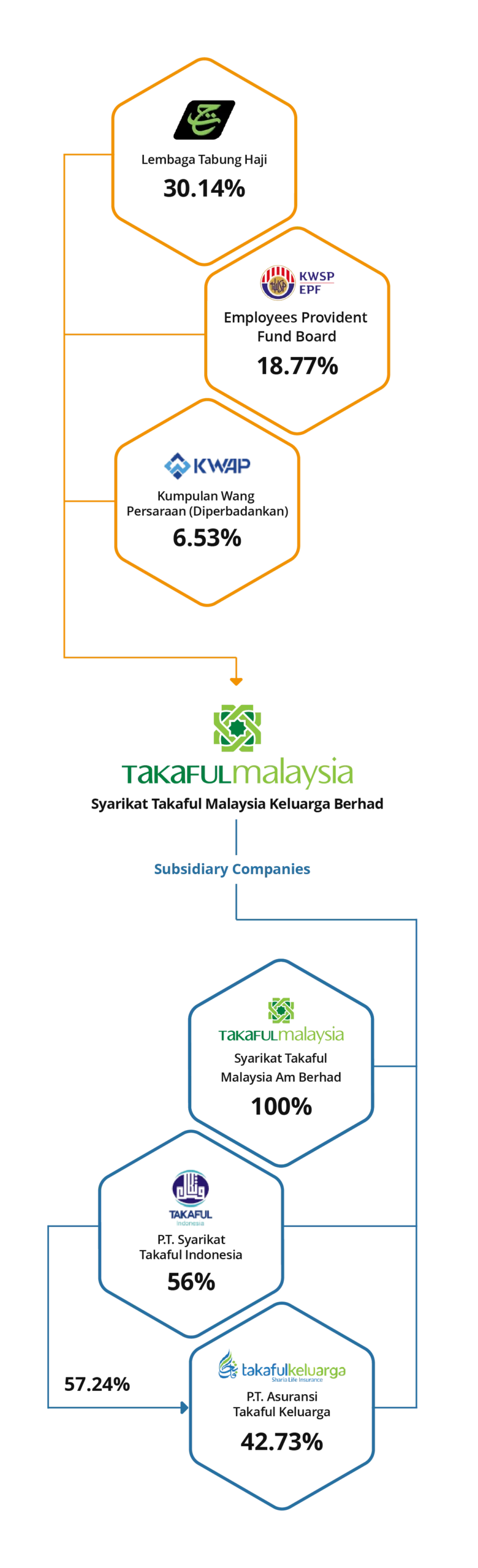

Our current shareholders are Lembaga Tabung Haji, Employees Provident Fund Board and Kumpulan Wang Persaraan (Diperbadankan) with shareholdings of 28.20%, 11.23% and 6.83% respectively in Takaful Malaysia as at 30 June 2022. The Financial Services Act 2013 (FSA) and the Islamic Financial Services Act 2013 (IFSA), which came into operation on 30 June 2013, has changed the landscape of the insurance industry. The new act requires conventional and takaful insurers to relinquish their composite licences, and conduct their life and general insurance businesses under separate units or subsidiaries.

With the restructuring, Syarikat Takaful Malaysia Berhad is now known as Takaful Malaysia Keluarga (STMKB) which will continue to operate the Family Takaful business. A new company by the name of Takaful Malaysia Am (STMAB), a wholly-owned subsidiary of STMKB will be handling the General Takaful businesses.

The conversion is in line with our strategic move to achieve our objective of maintaining the current lines of our business whilst facilitating the expansion into new lines of business in the longer term. We are optimistic that this change will provide greater growth opportunities and contribute positively to the prospects of both companies through greater synergy and effective execution of across- the-board strategies to lead the takaful industry development.